by John Edgar

•

10 March 2025

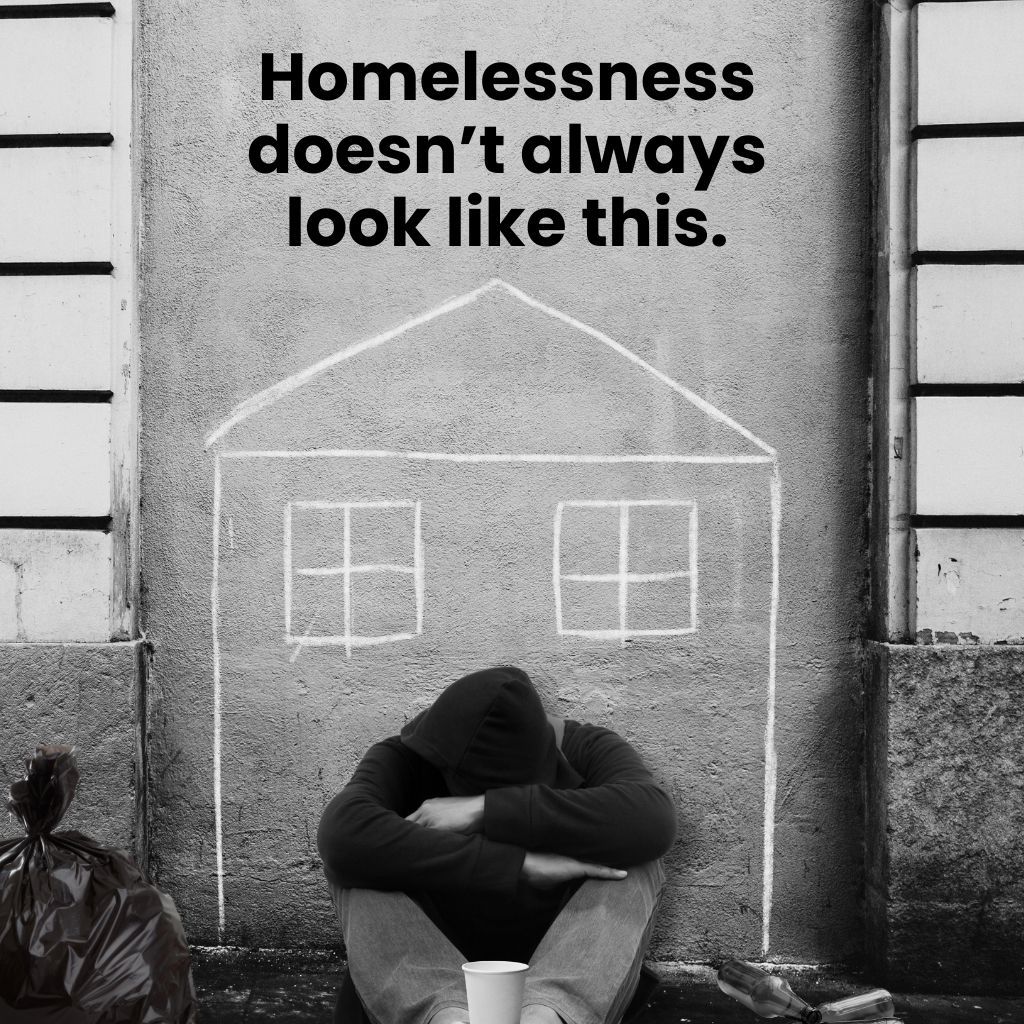

Poverty in Scotland isn’t just persistent - it’s growing. Despite the clear need for early intervention and financial education, funding cuts are making it harder to support those most at risk. In this thought-provoking article, CHAP Chair Ray Chaney explores the widening opportunity gap, the cost of inaction, and why we must rethink how we tackle financial insecurity. I’m old enough to remember the SMASH adverts of the 1970s, where barely-credible, tinny robots laughed uproariously at the thought of mashing potatoes (something, of course, we still do). But it’s hard not to imagine contemporary aliens also clutching their sides at the thought that the world’s most expensive handbag recently sold for two million dollars, while we simultaneously allow people to become homeless for lack of money for earlier intervention. In Scotland and across the UK, we have socialist-inclined governments, alongside poverty and inequality figures which continue to get worse, not better. The Joseph Rowntree Foundation’s report, ‘Poverty in Scotland 2024’ identifies that over one million people in Scotland continue to live in defined poverty, including a quarter of a million children. ‘Getting people back to work is the answer’, we are regularly told - and having an earned income generally helps an individual or family’s situation. But it’s very far from a single solution. According to the government’s own statistics*, wealth is far more unevenly distributed than income, with the wealthiest 2% of the population owning 18% of Scotland’s wealth. At the same time, around a third of Scottish adults do not have sufficient savings to last a month before falling into poverty. Even greater numbers of adults have zero pension savings. I work with people who are socially and economically excluded in one of the most deprived areas of Scotland. Through a charity focused on financial education, debt advice and homelessness prevention, we spend way too many of our resources helping people already teetering on the point of crisis. What we really want to do is to invest resources in crisis prevention and in achieving lasting social change but, in these times of austerity (by any other name), funding is being cut in ways which make me tear my hair out in frustration. Public sector funding for the provision of debt advice and support is being drastically cut, despite the fact this will demonstrably result in more Court and eviction costs; more health and stress issues being passed to the NHS; greater calls on emergency housing and on hard-pressed social services, as families are broken up. These are less cost-savings than costs being kicked down the road. Or, as the Rowntree Foundation report puts it, “A weak social safety net weakens our economy. Politicians often rightly talk of individuals locked out of the labour market by NHS waiting lists, yet ignore the impacts of the social security system on weakening people’s resilience when they need it the most. Good career advice rarely starts with recommending a period of deep financial insecurity and the anxiety that goes with it.” Our experience, over more than twenty years, is that people on low incomes tend to have poor financial knowledge, little financial interest, and hence highly restricted access to ways to live better on a budget. In families where living hand to mouth is the norm, paying higher prices for goods and services goes unquestioned. The thought of saving to avoid future crises seems laughable and the notion of having any real option a cruel fiction. We have gone into secondary schools in Ayrshire for twenty years, emphasising that money (whether a little or a lot) needs to be actively managed. We discuss in lively ways why debt should be avoided and suggest strategies how this may be achieved. Our efforts have been rewarded by becoming part of the curriculum in several schools, where we have also just been invited to devise pilot programmes for younger pupils. In addition, we offer free, financial education to adults within the community, where take-up has been greatly encouraging. The ongoing problem is that we, like many charities, are struggling to secure ongoing funding for our work. Local Authority budgets increasingly prioritise ‘necessities’ and maintaining the status quo, which means we see the chance of meaningful social change receding further. Early intervention and education to help young people understand the ways that money can be used and wasted, plus sharing understanding of how others thrive, can provide hope and opportunity. We actively challenge the belief that, just because something has always been this way, then this is the way it has to be. Through necessity, we are turning our attention to finding partners in the private sector who believe, as we do, that no society sustains itself by sucking funds from the many to give to the few; only chucking money at problems at the eleventh hour, with all the attendant human and societal misery that entails. That’s not my view of a healthy society, secure communities or potential for economic growth through meaningful change. Ray Chaney is the Chair of CHAP, a debt, welfare and housing advice charity based in Ardrossan in Ayrshire. Providing outreach into local communities, it delivers a range of advice, support and educational services. *The latest published government figures on wealth distribution in Scotland are from 2018-2020 (pre-pandemic) https://data.gov.scot/wealth/ For more articles like this, please connect with CHAP on LinkedIn .